Impact Investing in Commercial Real Estate Competition

Ideas to Foster Beneficial Social and Environmental Impact

The Impact Investing in Commercial Real Estate Competition is hosted annually by the Miami Herbert Business School and sponsored by the School’s Real Estate Advisory Board.

Impact investing refers to investments made in commercial real estate projects with the intention to generate a measurable, beneficial social or environmental impact alongside an appropriate financial return. The case competition tasks teams with identifying such projects and presenting a plan to bring them to fruition.

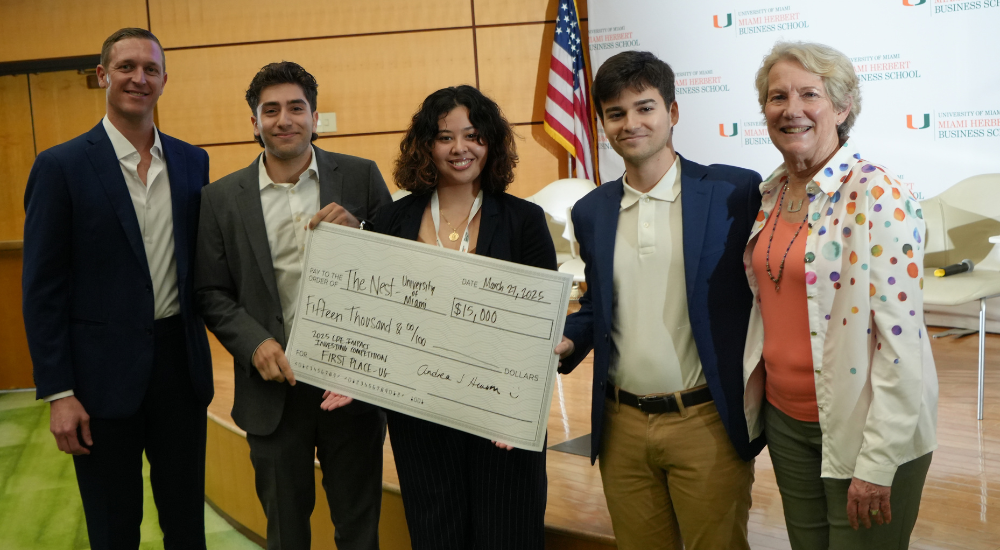

This year, final case presentations took place in person in Miami. The graduate team from Columbia University took first place and a $25,000 cash prize. The undergraduate team from the University of Miami took home first prize in their division and took home $15,000 cash prize.

Read more about the 2025 Impact Investing in Commercial Real Estate Competition here.

Competition Goals and Guidelines

- Bring attention to worthy projects in or near communities that host important academic real estate programs

- Allow students at the academic institutions that participate to interact with members of their advisory boards and local commercial real estate firms to learn about market conditions and under-utilized properties in their areas.

- Provide teams with feedback on their preliminary work by a group of professionals who are experts in assessing the risks and rewards of impactful investment in commercial real estate.

The call for the 2025-2026 competition and the case brief will be distributed in early August 2025.

For information, please contact Professor Heuson.

Competition Results

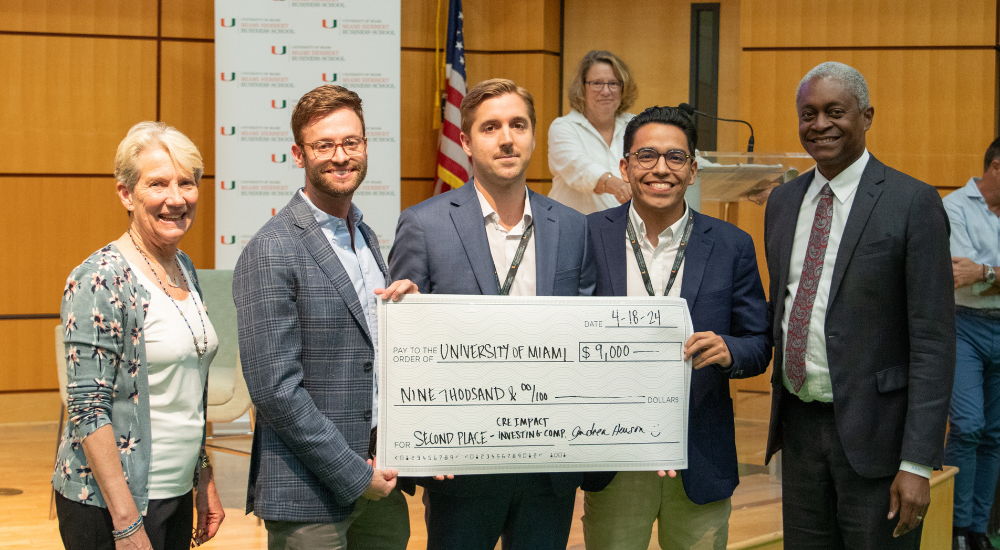

A team from York University, located in Toronto, took first place in the Impact Investing in Commercial Real Estate Competition, with a University of Miami team taking second and contestants from the University of Florida coming in third. York University’s win marked the first time that non-U.S. students have triumphed in the annual Impact Investing in Commercial Real Estate (CRE) Competition.

“The goal of the competition is to teach students to be transformative when it comes to CRE development,” said Miami Herbert Professor of Finance Andrea Heuson, who oversees the Accelerated MBA in Real Estate program. “We want to impress upon them that you can create impactful projects if you lay the groundwork properly.”

Plan of the Competition

The Impact Investing in Commercial Real Estate Competition is an annual event that has been held on eight occasions. It’s been hosted by the University of Miami Patti and Allan Herbert Business School and sponsored by Miami Herbert’s Real Estate Advisory Council. Along with subsidizing travel and accommodations for participating students, the Real Estate Advisory Council generated $25,000 in prize money that was shared between the three winners of the 2024 Competition.

The competition proceeded in two stages:

- Initial submissions are collected in mid-December. Most students submit class projects that have been enhanced to focus on one or more of five Impact components: Improving Building Design and Quality, Diversifying Ownership and Management, Urban Regeneration and Transit Oriented Development, Special Needs Users and Public Assets. Real estate professionals associated with Miami Herbert review each submission and these reviews are used to select finalist projects.

- Finalist teams have the opportunity to revise their projects in response to the initial comments before presenting to judges in Miami in mid-April, (all of the projects submitted receive at least two reviews from industry professionals to enhance the learning experience of finalists and non-finalists alike).

Initial Submissions

There were 18 submissions from ten schools—both record-setting numbers. Participating schools included Florida International University, Georgia State University, Penn State, Rutgers, SMU, the Universities of Chicago, Florida, Miami and North Carolina-Charlotte and York University. This year was the first year we opened the competition to undergraduate students and the response was quite strong so we plan to offer a separate undergraduate division next year.

Submitted projects were reviewed by CRE professionals at Acore, Affinius, Aztec, Berkadia Miami, BGO, CBRE Miami, DRA, FTI, Greenmills, Hines, JLL New York and Miami, Kayne Anderson, NRI, Related Group and Starwood. These reviews helped us select projects from Florida International University, the Universities of Chicago, Florida and Miami and York University to advance to the final round.

Judging the Finals

Judging took place at the Miami Herbert Business School. We are so grateful to our judges Manuel Martin, Kevin Fitzpatrick and Lynn Hackney.

Kevin Fitzpatrick, the lead judge, is the former head of Global Real Estate for AIG. Kevin is now the founder of Spring Bay Properties, a multifamily investment fund based in Southwest Florida. He is a firm believer that environmentally sound practices can enhance returns on real estate investments and is very well informed about technological advances in CRE materials. Kevin has judged the competition every year since inception.

Lynn Hackney is the Founder and CEO of Community Three, an adaptive re-use infill developer in Washington DC. Community Three has experience in using alternative building materials and in partnering with non-profit groups to achieve outcomes that benefit the community. This was Lynn’s second time as a judge.

Manuel Martin is the former global head of retail for Nuveen. Manuel now works as a consultant for a variety of European investors focusing on commercial real estate and corporate advisory. This was Manuel’s third stint as a judge.

York University winner Bianca Gornik, who’s working on a master’s degree in real estate and infrastructure, said she and her colleagues “thought we had a realistic chance of placing top-three. Our development is a mixed-use, purpose-built rental development that is located on transit-connected land and within a 10-minute walk to York University. The project creates a unique impact investing opportunity, through the provision of affordable housing units, socially-minded commercial tenants, and sustainability certifications.”

Student Feedback

The University of Miami was represented by master’s graduate student Daniel Cutimanco, David Flaxer and Nicolas Montana, all working on a Master’s of Real Estate Development + Urbanism degrees. Their fourth teammate was Joshua Simpson, who currently works for a Pinecrest commercial real estate firm, and had entered the competition prior to earning his Accelerated MBA in Real Estate in Fall 2023.

The University of Miami team focused on the Northside Area, an underdeveloped tract northwest of downtown Miami that is transitioning from an industrial designation to mixed-used.

“It’s a traditionally industrial area and the properties around that area are all industrial, or older houses and trailers,” Joshua Simpson explained. “So, there hasn’t been any investment in that area in quite some time. We wanted to have something that was impactful, but we didn’t want to have something that was gentrifying at the same time.”

2024-25 Competition

The winning projects from the 2023 competition are posted on the site now for interested parties. Please don’t hesitate to reach out to Professor Heuson, aheuson@miami.edu for information on the 2023-24 competition or the 2024-25 event.

Synopses of the 2024-25 Finalist’s project are below:

First Place Winner SCHULICH SCHOOL OF BUSINESS, YORK UNIVERSITY

YORK TEAM: Mary Liberto, Joshua Culmone, Darren Adamah, Bianca Gornik

Summary

The Intersection is a proposed mixed-use rental project in a transit-connected area near York University. It aims to provide affordable housing, socially minded commercial spaces, and sustainability certifications. The development plans include 1806 units across three buildings, with a focus on utilizing CMHC financing, phased construction, and tax incentives for sustainability and affordable housing. Partnerships with organizations like BGO and EllisDon are crucial for execution.

The project aims to address housing shortages and affordability issues in the Greater Toronto Area (GTA) by offering 20% affordable units and a diverse unit mix. Sustainability is a key focus, with LEED Gold certifications and efforts to achieve Net Zero Buildings.

The expected costs, projected income, and exit strategy are outlined, along with the capital stack and financing details. The project anticipates strong returns, but risks include municipal approvals, project delays, and meeting deadlines for tax rebates. Overall, the project aims to generate employment, increase property value, and contribute to housing availability in the area.

Second Place Winner UNIVERSITY OF MIAMI

UM TEAM: Joshua Simpson, Daniel Cutimanco, David Flaxer, Nicolas Montana

Summary

Miami's Northside neighborhood presents a significant opportunity for transformation and inclusive growth despite historical neglect and poverty. In contrast to neighboring areas experiencing gentrification, Northside awaits revitalization. A visionary real estate developer has the potential to lead this change through a mixed-use, transit-oriented development. By integrating affordable housing, workforce housing, commercial spaces, and educational facilities, the project can uplift the entire community. Crucially, the inclusion of educational programs aims to break the cycle of low-wage jobs, promoting upward mobility. Sustainability measures and public green spaces demonstrate a commitment to environmental stewardship and community well-being, setting a standard for responsible urban development. Investing in Northside goes beyond profit—it's about fostering social equity and creating a sustainable, vibrant community for future generations.

Third Place Winner WARRINGTON COLLEGE OF BUSINESS, UNIVERSITY OF FLORIDA

UF Team: Boyd Merrill, Ruben Restrepo, Zach Flaksman, Chris Kennedy & Alex Azar

Summary

Affordable housing is being introduced to Normandy through a multifamily development offering a mix of affordable and market-rate units. Affordable units will be priced at no more than 30% of gross income for households earning 20%-80% of the area median income. This initiative aims to alleviate housing cost burdens for over 50% of Jacksonville households, particularly those in impoverished areas, while also increasing housing supply. Inclusionary housing is expected to promote social cohesion between affordable and market-rate residents. The project aims to optimize affordability while aligning with financial constraints and internal rate of return projections, with plans for at least 231 affordable units. While not strictly adhering to the principles of a 15-minute city, the development aims to emulate this concept through an innovative 5-pointed star mobility model, ensuring essential services are conveniently accessible within a short distance.

Impact Meets Innovation: Highlights from the 9th Annual Case Competition on Commercial Real Estate Investing

Each year, the Miami Herbert Business School brings together some of the brightest student minds in real estate to tackle a powerful challenge: creating commercial real estate projects that not only generate solid financial returns but also deliver measurable social or environmental impact. That’s the essence of impact investing—and it was the central focus of this year’s Ninth Annual Real Estate Impact Case Competition.

The 2025 competition was bigger than ever, with a record-breaking 17 submissions from nine universities, competing in both graduate and undergraduate divisions. Projects were judged by seasoned real estate professionals, including Miami Herbert alumni and members of the school’s expansive real estate network.

After an initial fall review, six graduate and two undergraduate teams advanced to the finals, where they refined their proposals and presented them live to a new panel of CRE experts this past March in Miami.

Graduate Finalists

Manhattanville (Columbia University)

This West Harlem proposal offered a holistic urban regeneration model, including education, workforce housing, business incubators, and community spaces. With a 22.4% Levered IRR and strong institutional partnerships, it combined financial strength with deep community value.

Sylvan York (Schulich School of Business)

Schulich, last year’s winner, returned with a mixed-use rental development in Toronto. Built with mass timber and offering 41% affordable housing, the project stood out for its fast build time, 20 %+ IRR, and innovative financing.

SoMi Parc Phase II (University of Miami)

This local team proposed a transit-oriented, mixed-use complex in South Miami, aiming for LEED Platinum certification. The project blends market-rate and affordable housing with strong community integration.

The Pulse (UNC Charlotte)

This proposal targeted growing healthcare needs with a medical office project in Cornelius, NC. Designed for LEED Gold Certification, it earned points for sustainability and a strategic location adjacent to a major hospital.

Wisconsin House (Georgetown University)

Focused on affordable, family-friendly housing in Washington, D.C., this plan included a preschool and LEED Gold certification. Its strategic use of tax credits and family-focused design made a lasting impression.

15th Ward Unity (Cornell University)

Cornell capitalized on Syracuse’s I-81 teardown, pitching a plan that reconnects neighborhoods and aligns with Micron’s regional expansion. Judges noted its strong social mission, community-centered design, and well-phased execution plan.

Undergraduate Finalists

The Nest (University of Miami)

This 8-story housing project reimagines industrial-zoned land in Miami’s Allapattah neighborhood. It features 30% affordable units, modular construction, sustainable design, and smart home tech, striking a smart balance between innovation and affordability.

Ecologicus Tower (Rutgers University)

A bold 52-story mixed-use tower in downtown Newark, this project is planned to include 604 residential units (44% affordable) and retail space. Its financing leaned on public subsidies, while pushing sustainable design on a large scale.

Looking Ahead

With four new schools already expressing interest in joining, the 10th Annual Case Competition is shaping up to be even more competitive. Look out for the call for entries this August.

We’re grateful for the continued support of the Real Estate Impact Conference sponsors, the Miami Herbert Real Estate Advisory Board, and our generous donors, who help cover travel and lodging costs for our finalist teams, making this a truly accessible, national competition.

Thank You to Our Industry Reviewers

We deeply appreciate the time and insight shared by our first-round reviewers: Tunde Akinyemi (BGO), Patrick Johnson (Berkadia), Calvin Clancy (JLL), Brian Lessans (Kayne Anderson), Tony Del Pozzo (The Related Group), Will McIntosh (Affinius Capital), Mary Dooley (JLL), Michael Monteleone (Grand Peaks), Michael Duganich (TD Bank), Matt Shainberg (Barings), Leslie Fang (BGO), Oscar Sol (Greenmills), Chris Gherlone (Alchemy/ABR), Curtis Tsang (Trez Capital)

And Our Esteemed Judges

Special thanks to our final round judges:

- Kevin Fitzpatrick, Founder & CEO, Spring Bay Properties (Lead Judge)

- Hanna McQueen, Development Manager, Atlantic Pacific Communities

- Joanne Rosen, Founding Partner, Beacon Advisors

- Yuri Zanini, Senior Director & Assistant Fund Manager, Hines

We can’t wait to see what the 10th Annual Competition will bring

Finalist Submissions from April 2025

- Graduate Winning Team | Columbia University

- Undergraduate Winning Team | Miami Herbert Business School | University of Miami

Finalist Submissions from April 2024

- Schulich School of Business | York University

- Miami Herbert Business School | University of Miami

- Warrington School of Business | University of Florida

Finalist Submissions from April 2023